Agilio HR Strategy Director, Jon Curtis discusses the legal requirements employers need to understand when using a settlement agreement. This article has since been updated on 22nd January 2021 by senior employment lawyer Matthew Ainscough, who specialises in discrimination and employment litigation.

Unfortunately, it is sometimes the case that employers and employees fall out! When this results in a parting of ways which the law would deem unfair, it is sometimes possible to “do a deal” which results in settlement between the parties.

Settlement agreements are written contracts that record the settlement of a dispute between an employer and an employee, and are legally enforceable. Often, they are used when an employee leaves a job and the employer offers a cash payment in return for various promises from the employee, including a legally binding promise that they will not bring any claims against the employer.

Settlement agreements used to be called compromise agreements, until 2013 where the name was changed – presumably to make it easier to understand what they are, although some people still refer to them as compromise agreements.

The legal requirements for a settlement agreement

A settlement agreement has to be in writing and it should settle a particular complaint, although in reality they are often used to settle all and any disputes between the parties (and note that sometimes they are used where there is no dispute). The employee has to get legal advice from a solicitor who has to be independent from the employer.

What terms commonly feature in a settlement agreement?

- Firstly, the employee promises not to bring any claims, and secondly, the employer promises to pay some money!

- Often the employee has to give a tax indemnity in relation to the money paid, because it is often paid tax free (up to the first £30,000 anyway).

- Often the employer will want confidentiality promises from the employee. Sometimes these clauses are referred to as “gagging clauses” in the press, although it is worth noting that they cannot be used to prevent the employee from whistleblowing to regulators or relevant authorities.

- Claims for latent personal injuries and accrued pension rights will normally be carved out of the agreement.

- Generally speaking, the employer will pay a contribution towards the employee’s legal fees.

- Often the employer will provide a reference, and where the departing employee is a senior executive, sometimes an announcement to circulate around the workplace will be jointly agreed.

What is an ex gratia payment?

Ex gratia is Latin for “without obligation”. Where there is a dispute between an employer and an employee, it is possible for the employer to make an ex gratia payment to the employee tax free up to £30k. Clearly, if the sum of money is required to be paid under the contract (for instance a golden handshake clause), the sum is not “ex gratia” and is rightly taxable.

In 2018 the law changed so that all payments in lieu of notice (PILON) are now fully taxable.

Protected conversations

It is possible for employers to undertake confidential discussions about the termination of employment. In other words, if an employer wants an employee to move on, the employer is able to make the employee a settlement offer without fear of the employee using that offer against the employer in an employment tribunal. This is known as having a protected conversation with the employee. It is protected because the employee is unable to rely on the contents of the conversation in any future claim.

However, protected conversations only apply to ordinary unfair dismissal claims and they do not apply to discrimination, breach of contract, harassment or whistleblowing claims. Please also note that the protection does not apply if the employer is guilty of any improper behaviour such as applying pressure to accept the offer, suggesting the employee will be dismissed if they do not accept the offer, using aggressive or intimidating language or actions, discriminating against or harassing the employee, or not allowing a reasonable period of time for the employee to think about the offer.

Documenting settlement agreements

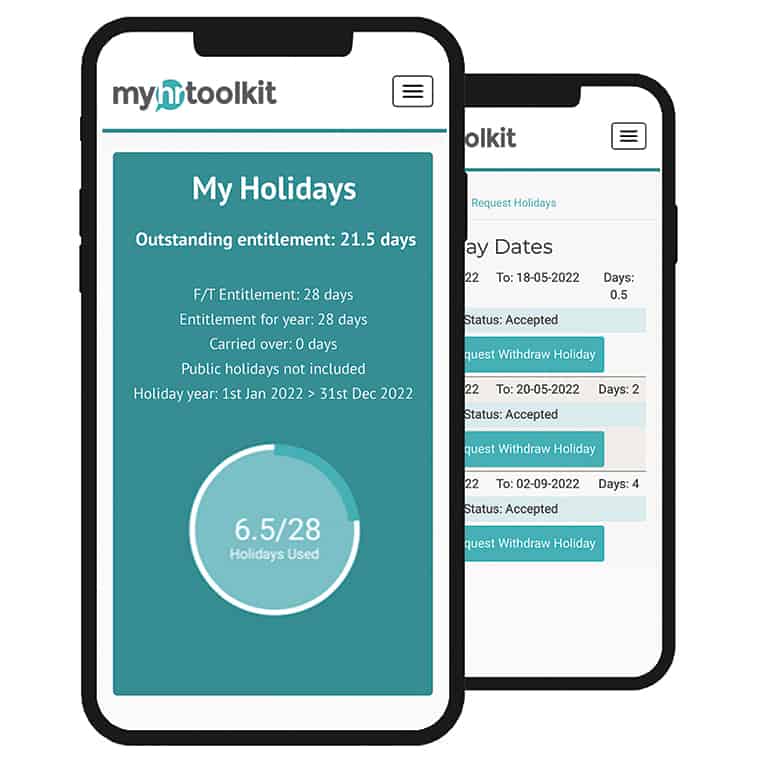

As with all company decisions with legal ramifications, it is important to document settlement agreements within the business with accuracy and consistency, as the employer may need to rely on the agreement in the future. I recommend using document management software, as part of a HR software platform, to record and track settlement agreements in a secure and detailed way, helping you maintain accurate records.

Record and track settlement agreement documents easily and securely with document management software

Read more from the myhrtoolkit blog

Written by Jon Curtis

Jon Curtis is Managing Director at myhrtoolkit and previously an employment solicitor. He co-founded myhrtoolkit in 2005 and become full-time MD in 2018.

Holiday Planner

Holiday Planner Absence Management

Absence Management Performance Management

Performance Management Staff Management

Staff Management Document Management

Document Management Reporting

Reporting Health and Safety Management

Health and Safety Management Task Management

Task Management Security Centre

Security Centre Self Service

Self Service Mobile

Mobile