The Coronavirus Job Retention Scheme (CJRS) has been hugely helpful for UK businesses, but also highly complex in terms of making accurate claims. The HMRC are beginning to crack down on furlough fraud, so it's advisable to perform a furlough health check to make sure all your claims are correct.

Our guest speaker, solicitor Alicia Collinson of Thrive Law, will guide you through the concept of furlough fraud and how to ensure your organisation is making claims to the CJRS correctly. She covers the following:

- How prevalent is furlough fraud and what are the potential consequences?

- The proposed 90-day window to report mistakes in historical furlough claims

- The shift to flexible furlough and how to adjust your claims accordingly

You can also view the presentation slides for this webinar here.

Please note that this webinar uses the information that was available as of August 12th 2020. From July 1st 2021, employers will start contributing towards the costs of furloughed employees' wages. Read this government furlough guidance to learn more.

Related resources

Webinar: Further furlough extensions: the implications for SMEs

Article: Can employers reduce staff hours – and should they?

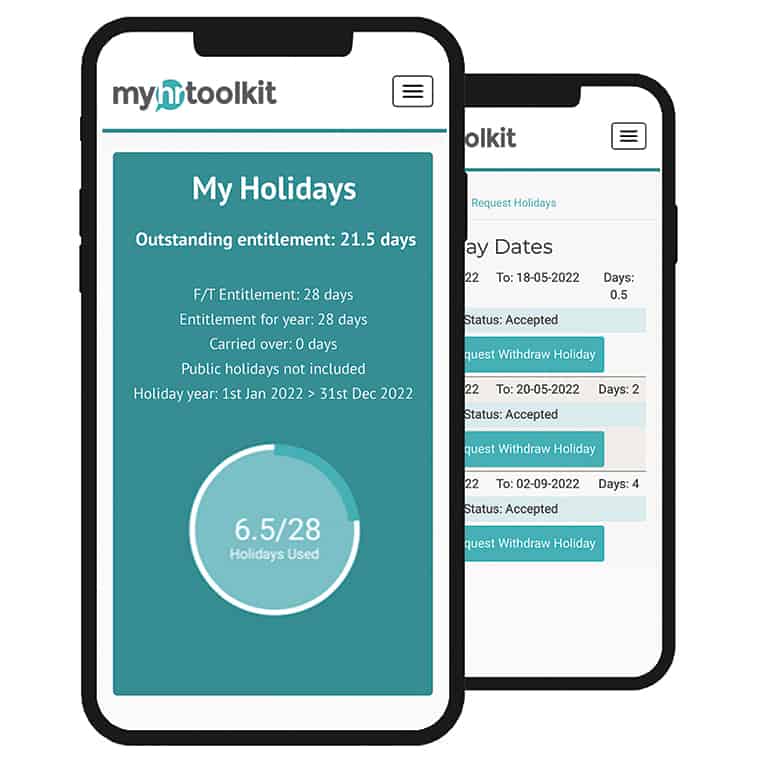

Holiday Planner

Holiday Planner Absence Management

Absence Management Performance Management

Performance Management Staff Management

Staff Management Document Management

Document Management Reporting

Reporting Health and Safety Management

Health and Safety Management Task Management

Task Management Security Centre

Security Centre Self Service

Self Service Mobile

Mobile