Find out more about general practices around calculating holiday entitlement for casual and zero hours workers with this overview guide from myhrtoolkit, with input from employment solicitor Toby Pochron of Freeths LLP.

Please note that this guide focuses on calculating zero hour contract holiday entitlement, not holiday pay, and that you should seek specific legal advice to ensure all workers receive statutory holiday entitlement correctly.

Calculating holiday entitlement for a zero hour or casual worker is a more complex process than calculating entitlement for staff who work regular hours. This is because, as a type of variable hours employee, someone working on a casual or zero hours contract does not have a fixed working pattern, though some employees may have a contracted minimum number of guaranteed hours within a given period. In this guide we will provide an overview on how to calculate casual staff holidays pro rata.

What are the holiday entitlement rights of casual workers?

Anybody working for an organisation who is not self-employed (so, an employee or a worker) is entitled to 5.6 weeks’ statutory holiday according to the Working Time Regulations 1998. This includes employees on variable hours contracts, who count as part-time employees in legal terms. The statutory entitlement can also include bank/public holidays.

The statutory total equates to 28 days’ leave for a full-time employee working 5 days a week; this needs to be calculated pro-rata for anyone who does not have a full-time working pattern.

Learn more: Casual workers' rights: an FAQ for employers

Issues in calculating holiday entitlement for casual/zero hours workers

There are a few potential issues in calculating holiday entitlement for these types of workers. Firstly, government guidance on calculating holiday entitlement for workers with irregular hours is rather vague. According to the UK government’s holiday entitlement calculator, “there are no regulations on how to convert [statutory holiday] entitlement into days or hours for workers with irregular hours.” They further advise in their guide to calculating entitlement:

“In practice, if needed, employers may wish to calculate average days or hours worked each week based on a representative reference period, although the Regulations do not expressly provide for this. In all cases, employers must ensure that each worker receives at least 5.6 weeks’ annual leave per year.”

Secondly, when an employee has fixed working hours, they can receive that entitlement at the start of a holiday year/when they start their role and request annual leave in advance. For casual and zero hours workers, it is more difficult to predict how much annual leave they will have within a given year. As there is no fixed work pattern on which to base annual leave, the entitlement should instead generally be kept in weeks.

Thirdly, for employees with variable hours, there is an additional issue of whether they take their holiday during hours they would otherwise work or not. It may be appropriate to grant paid annual leave to be taken during periods when no work is performed. This depends on the circumstances, and employers must ensure workers are able to take their full leave entitlement.

The 12.07% holiday accrual method

As we outline in our guide to calculating holiday entitlement in hours, you can use the 12.07% method to calculate statutory holiday accrual for workers with irregular hours. This can act as a useful casual/zero hours holiday calculator.

The standard working year is 46.4 weeks (52 weeks - 5.6 weeks statutory entitlement) and 5.6 weeks is 12.07% of 46.4 weeks. This includes the bank holidays entitlement so workers should not get any additional pay for bank holidays.

Using this method, a worker gets just over 7 minutes of holiday entitlement for every hour they work (more specifically, 7.242). Employers should check holiday entitlement for casual/zero hours workers regularly to ensure their holiday accrual amount is accurate. For example, if someone has worked 80 hours, they will be owed 9.656 hours of holiday entitlement according to the following calculation:

12.07% (12.07 ÷ 100) x 80 = 9.656 hours (579.36 minutes)

Please note that, if you offer contractual holiday on top of the statutory amount, you will need to adjust the percentage you are using to ensure it is accurate.

How do you round holidays?

You can choose to round up the total amount of holiday entitlement, but legally you cannot round it down. Note that you can round up to nearest half day or hour.

What about decimal points?

When a worker’s holiday entitlement amount goes into decimal points, it can be difficult to know where to stop and where to round up. As long as you make sure to have a policy on this, you can keep it consistent and fair for all workers. For example, you may wish to always round to 2 decimal points.

Potential edge case issues with the 12.07% method

*The case below was recently heard at the Supreme Court. See our updated Harper vs Brazel blog post for clarification on the issue of holiday accrual for part-year workers or workers with irregular hours.

A current case going to the supreme court suggests the 12.07% way may not always be the correct method to use for all workers. Employment solicitor Toby Pochron of Freeths LLP comments:

“The calculation is accurate in most cases, but is not guaranteed to comply with the regulations. This was the crux of the issue in the legal case of Harpur Trust v Brazel [2019] EWCA Civ 1402. The Court of Appeal decision in this case could (and we stress could) have an impact on the arrangements for employers who engage employees in a non-set or no-fixed fashion.

“In Brazel, the Court of Appeal confirmed that holiday entitlement should not be calculated on the basis of 12.07% of hours worked but instead should be based on an average of hours worked in the 12 weeks before leave is taken (this was before the increase to the 52 week reference period in April 2020). This was to address an inequality (or potential for inequality) in the methodology of calculation, as according to the 12.07% rule a worker would accrue no leave if no work had been done. This can cause specific catches for those on seasonal or term time contracts.

“The Brazel case has not changed the law; it has merely highlighted a problem that already existed with the 12.07% method. If you have historically pro-rated holiday entitlement and applied this to remuneration of those who work non-fixed or variable (non-normal hours) then it would be a good time to review this method. Brazel is going to the Supreme Court, so more formal guidance could be issued soon.”

This particular case was brought by a teacher who worked varied hours but just during term time. The more regularly an employee works the more the 12.07% method will be accurate, the more sporadic the work, the less accurate the 12.07% method will be according to Brazel.

Any employer using the 12.07% method of calculation should take HR/legal advice to ensure that this is the correct method of entitlement in any specific situation. As far as we understand it, most employers and advisers are continuing to use the 12.07% method for now, but should keep the situation under review and should consider using the WTR method in specific cases based on legal and HR advice.

It’s also salient to recognise that Britain is currently in the process of exiting the EU and the WTR is European legislation – this may also have an impact on holiday rules.

Learn more: Brexit: what are the consequences for SMEs?

Addressing issues with holiday accrual

When a worker with irregular hours has just started their role or is near the beginning of the holiday year, they may wish to book holiday in advance, beyond what they have accrued. In these cases, it is the company’s discretion as to whether they grant the request.

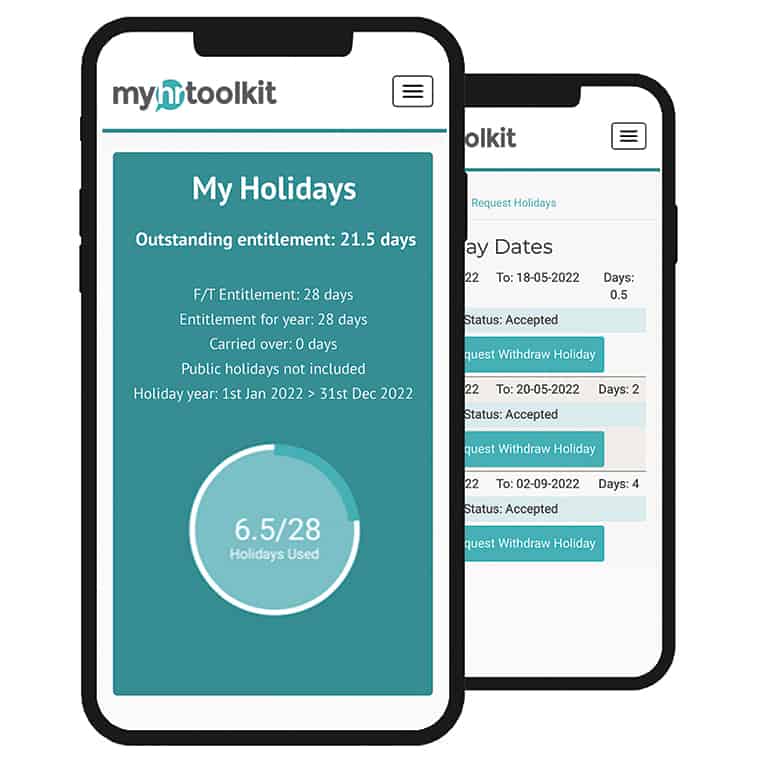

Holiday management software can help businesses monitor this as accurately as possible. Myhrtoolkit presents the worker and relevant manager with a warning message when a variable hours worker makes a request that goes beyond what they have accrued. The system also predicts whether the worker will accrue the difference by the end of the holiday year.

Find out how holiday management software can help your business with holiday entitlement calculations and administration

Note that you cannot refuse a worker’s holiday request if they have accrued enough holiday at the point where they ask for it. Employers can refuse holiday requests for other reasons, for example on operational grounds. Read our guide to holiday leave notice to learn more.

Calculating holiday entitlement for a leaving worker

When a worker on a zero hours or casual contract is leaving the organisation, they may still be owed statutory holiday entitlement (which they can take as holiday or receive payment in lieu). Read our guide on calculating holiday for leavers for more information around this area.

Written by Toby Pochron

Toby Pochron is a Senior Associate in the Freeths LLP Employment Law department. He was a Partner in the Employment Law department of Ironmonger Curtis.

Holiday Planner

Holiday Planner Absence Management

Absence Management Performance Management

Performance Management Staff Management

Staff Management Document Management

Document Management Reporting

Reporting Health and Safety Management

Health and Safety Management Task Management

Task Management Security Centre

Security Centre Self Service

Self Service Mobile

Mobile